How to Verify PayTM KYC - Minimum KYC, Self KYC, and Full KYC

Online transactions and digital wallet underwent a transformation, from fad to fundamental. India’s biggest digital wallet, online payment platform is Paytm. PayTM means Payment Through Mobile. Launched in the year 2010, the e-commerce site has now become an indispensable part of the online marketplace. The portal began as a common platform for mobile recharges, and utility bill payments. It enables a user to transfer cash from bank account to paytm wallet through debit cards, cards, and net banking. Consumers can pay via paytm wallet without the use of cash. Paytm has ties with 8 lakh merchants. Ever since the launch, paytm upgrades frequently to provide better services to the customers. There is no necessity to carry your credit or debit cards. You can pay instantly from your mobile with paytm account. Paytm also emerged as an e-commerce site and captured a giant share in the online marketplace. Lately, paytm allows the users to transfer money to another paytm wallet or to a bank account.

PayTM KYC – Mandatory Update

Paytm mimics the services of the bank since it facilitates all transactions enabled by the banks. In order to avoid fraudulent transactions and safeguard the interest of the users, paytm mandated KYC updates for all customers. KYC – Know Your Customer. It is nothing but personal verification of the account with the government issued identity cards. KYC verification is common for banks to authenticate the account holder. The similar rules apply for Paytm too. The Reserve Bank of India governs the paytm wallet, which assures safe transactions. So, as per RBI norms and guidelines, Paytm mandates customers to update KYC. Paytm KYC customer has access to special features in paytm. Besides, to open a Paytm bank account, Paytm KYC verification is important. Paytm limits the value of transaction per user to Rs. 5000 per transaction and Rs. 25000 a month for normal users. If you become a paytm KYC verified customer, the upper limit of transaction per month can be availed up to 1 lakh. Paytm KYC form verification requires identity proof and address proof of the customer. You can provide the identity cards issued by the Government to validate your account for approval.

Get 100% Paytm Coupons, Promo Codes For Movie Tickets, Recharge, Bill Payments

Paytm KYC Verification: Minimum KYC, Self KYC, and Full KYC

Paytm KYC is categorized into two types, minimum KYC, self KYC and full KYC. Paytm KYC online verification requires Aadhar number of the user. So, it is easily done through mobile App. However, if your Aadhar number is not linked with any mobile number, you have to request a home visit for paytm KYC verification.

Minimum KYC

Minimum KYC is authenticating the paytm user account with any government-issued identity card. This has become mandatory for all new user registrations. This is generally done as paytm KYC online verification. Maximum limit of transaction per month for minimum KYC is Rs. 10,000 and monthly spending limit is Rs.10,000/-

Self KYC

It is mandatory for existing paytm users. Update of Aadhar number verifies the user account. This process is authenticated by OTP for paytm KYC online verification. If you are unable to do paytm KYC online verification with Aadhar number, you can get the paytm KYC agent contact number and visit a KYC verification center in person to authenticate the paytm account. Maximum limit of transaction per month is Rs. 1,00,000/- there is no upper limit on the monthly amount spent via paytm.

Full KYC

Full KYC is manual verification of the identity and address proofs of the user, manually. If you look at how to verify paytm KYC online for full KYC update, you won’t be able to complete the process. For full KYC verification, you should look for the “paytm KYC centers list” or paytm KYC center near me. Maximum limit of transaction per month is Rs. 1,00,000/- there is no upper limit on the monthly amount spent via paytm.

Three Ways for Paytm KYC Verification

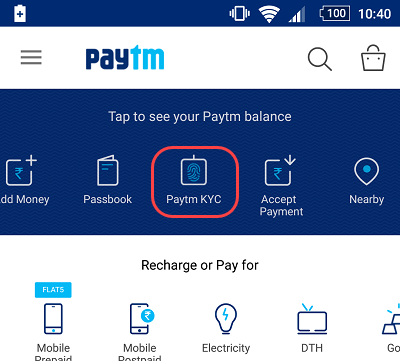

1. How to verify paytm KYC online?

Paytm KYC online update is very easy. Login into your paytm app. It takes no more than a minute. After login, tap on the “KYC” option

Enter the Aadhar number in the requested column. Validate the transaction with OTP.

Verify the personal information, and your KYC is approved. Paytm KYC online verification is possible only with Aadhar number. No other identity card is accepted for online KYC update.

If you do not have Aadhar number, visit a Paytm KYC verification center. Paytm KYC online verification for self KYC and Full KYC verification has only one major difference. Self KYC verification is valid for one year.

Full KYC verification has validity for several years. However, whether it is minimum KYC or self KYC, within 12 months of updating the identity, the user shall validate their account with full KYC.

2. How to verify PayTM KYC at Home

Paytm KYC verification at home is possible in two ways. Generally, home verification is done for full KYC.

- Navigate “paytm KYC verification center near me” and visit the center in person. So after finding the nearby paytm KYC verification center, visit the center with the original identity cards as proof to update KYC.

- Schedule a home appointment to get an authorized agent to your home at your convenience.

If you are unable to find an agent nearby your home or office, you can make a request to give a home visit for the verification. Paytm has authorized agents for KYC verification at your home or office. There is no need of paytm KYC form online to submit for verification. It can be done through the app, by updating your Aadhar card number for minimum KYC. For full KYC verification, you can contact the paytm KYC customer care number to clarify the queries.

3. How to find the paytm KYC center list for verification

Paytm has set up many paytm KYC centers. You can Google “paytm KYC centers near me” or locate the nearest paytm KYC center list using the paytm app. You can initiate the KYC verification using the mobile app. The app helps you find the Paytm KYC center list. Here are the step by step procedures to initiate verification of paytm KYC online. It is a four-step process.

1. Login the paytm app entering the username and password

2. After login, on your mobile screen tap on the “nearby” option.

3. The mobile screen displays a new section, choose “Upgrade Account” to find the paytm KYC center list for verification.

4. The app shows the paytm KYC center list. The list contains the name of the center, address, distance from your current location and contact number.

Your search for “paytm KYC center near me” is complete. Choose the center that is nearest to your location. Carry Aadhar card or PAN card as identity proof to the center and verify your account.

Things to remember to get Full Paytm KYC Home Verification

For online verification, you need to provide Aadhar number. KYC is done in less than a minute. However, if you When you request a home visit to verify paytm KYC at home, look for the Golden Gate Icon App on the agent’s phone. This app is the only option to complete the paytm full KYC. Without Golden Gate app, you cannot get full KYC update. The agents must take the copies of the identity and address proofs only through the Golden Gate App. Do not share the paytm 6 digit code after completion of the full KYC verification. Do not send the copies of the documents to the agent’s WhatsApp number or mail or any other app.

Paytm KYC Verification – Quick Facts about the transfer, using existing money

- Paytm KYC online verification via the app is approved instantly. If you visit a KYC verification center near you, it takes a few hours to one day for verification approval. Home visits may take time up to 7 working days from the date of request to do the KYC.

- If you don’t do KYC, you cannot send money to paytm wallets, receive cash and transfer to bank accounts.

- If you don’t do KYC, you can still use the wallet balance to pay bills and all online payments. However, to add money or receive money, authentication with any government ID is essential.

- Full KYC is done only through direct one to one meeting. Either you drop by the paytm KYC verification centers or an agent drop by your home.

- KYC users can hold a maximum of Rs. 1 lakh a month and transfer a maximum of Rs. 25,000 a month to another bank.

As per RBI guidelines, non-verified users have restrictions to the following:

- Not allowed to add money to the paytm wallet

- Not allowed to send money to other wallets or banks

- Not allowed to get the special features like unlimited spending limit, the upper limit on total balance etc

- Paytm KYC verification provides you a digital bank account with zero balance, in 2 minutes. With fully verified KYC, paytm user can open the savings account. Paytm Payments Banks has been launched and is available only for full KYC verified paytm users. The paytm wallet is governed by the Paytm Bank. The user also gets virtual debit card and passbook. Don't forget to get exclusive paytm coupons to save money on your recharge, bus booking, movie tickets and more. KYC is free for all types of paytm KYC verification. Whether, it is paytm KYC online verification, or paytm KYC verification centers, agent verification, paytm charges zero.

Frequently asked questions

Q1 : Why do you need Aadhaar for Paytm wallet if Supreme Court has extended indefinitely linking of Aadhaar for Bank account?

Paytm wallet requires any government approved photo identification for performing the KYC. You can submit any one of the following id proofs: Aadhaar card, Voter ID card, NREGA card, Driver’s license, Passport etc.

Q2 : Why do you ask for only Aadhaar for KYC?

Aadhaar card is just one of the documents that you can use for KYC purpose. The benefit of using Aadhaar card is, you can complete the KYC from your Paytm App. You do not require a home visit from Paytm executive as the biometric data is already available in case of Aadhaar card.

You can also use other documents for KYC and a Paytm executive will visit your home to complete the process manually.

Q3 : What is Paytm Payments Bank Limited? Why does Paytm wallet terms and conditions and SMS mention Paytm Payment bank (PPBL)?

Paytm Payments Bank is India’s only mobile bank that operates wholly through a mobile app. It offers you zero balance accounts, zero digital transaction fees, and many such perks.

Paytm app is owned and operated by Paytm Payments bank. Hence, all communications like SMS and terms and conditions refer to Paytm Payments Bank Ltd.

Q4 : Why are you opening Bank Account while doing KYC? Can the agent who is doing my KYC also open my Bank account?

Paytm, does not automatically create a bank account for every customer who does the KYC. You can, however, request an account to be created for you. The Paytm executive, who is sent for the KYC, can put in a request for you. Once the request is received an SMS is sent to the customer asking for confirmation. Only after receiving the confirmation, an account can be created.

Q5 : I think I have accidentally given my confirmation for bank account but I don’t need bank account

If a bank account request is sent in by error, or the confirmation is sent in error, a customer can always cancel the account within 48 hours of opening the account.

You will need to raise a complaint by calling the helpline at 0120–3002699 and press 1.

Q6 : What are charges for KYC?

KYC authentication process is not chargeable. You will not need to pay any fee to complete your Paytm KYC. It is free.

Q7 : Why do you collect additional details post verifying my Aadhaar?

As per the RBI Directive: point 57, all e- wallets should be CERSEI compliant. Hence, if complete details are not available with the UIDAI, then, a customer will be required to furnish all the required information.

Q8 : Why KYC itself is a in person process. Why can’t I do it on Paytm app?

As part of your KYC process, a customer is required to furnish address proof, id proof, etc. If your Aadhaar card is not linked to your mobile or if complete details are not available with the UIDAI, a customer may need to schedule a visit with the Paytm agent.

Q9 : What are charges for KYC?

KYC verification is an absolutely free process. You are not required to pay any fee.

Q10 : Can the agent who is doing my KYC also open my Bank account?

The Paytm agent, sent for KYC verification will not directly open a Paytm Payments Bank account for a customer. The request will have to be sent by the customer themselves and the confirmation message will be sent to the mobile linked to the Paytm account.

Only after the customer confirms the request via SMS, the account opening will be processed.

Q11 : What if I don’t do KYC?

To avail the full benefit of your Paytm wallet and Paytm payments bank, a customer needs to complete the process of KYC. Without the KYC verification, a customer can use the money to pay bills, but money transfers, cashback benefits, adding money to wallet, etc. cannot be availed.

Q12 : What happens when I hit my wallet limits of Rs.10,000 and I have not done my KYC?

Once a customer provides the Document ID of either Aadhaar card, Pan Card, Passport etc, they are considered a minimum KYC user. Such users can make payments and purchases only upto Rs 10,000. Money transfers to other users or bank accounts are not allowed for Minimum KYC users.

Once the transaction limit reaches Rs 10,000, the user will not be able to make any more payments using Paytm for that month.

Q13 : I have not done my full KYC. Can I still receive money from other Paytm user?

Once a Paytm user provides the document ID of either Aadhaar card or PAN card or passport number etc, they will become a minimum KYC customer of Paytm. Such users can add money to wallet from bank account, however, they will not be able to send or receive money from other Paytm users or wallets.

A minimum KYC customer needs to complete full KYC within 12 months of initiating the process.

Q14 : I am a KYC user but I still can not send money?

Full KYC users can send and receive money from friends and family through the app. For amounts greater than Rs 10,000 and upto Rs 1 Lakh, the user needs to add the beneficiary to the settings. Log into your Paytm app and go to your Profile. Under profile, scroll down to ‘Manage Benficiaries’ and click on it. Here you can add new beneficiaries and transfer funds upto 1 Lakh.

Q15 : I have money in my Paytm balance and I have not completed my KYC. Will I be able to use this money?

Without KYC verification, a user cannot avail full benefits of the Paytm app. However, the money in the wallet is still available to pay bills.

Non-KYC customers cannot add further money to the wallet, transfer funds to friends and family, avail cashbacks and other deals etc.

Q16 : What are the documents needed to complete my KYC?

To complete the KYC verification, a customer needs to provide any government issued photo identification like Aadhaar card, PAN card, Passport, NREGA card, Driver’s License, Voter ID card etc. You can show the original of any of the above documents and complete the process.

Q17 : How much time will it take to complete my KYC?

The process of KYC verification can be completed through one of the 3 ways listed here:

- Provide your Aadhaar card number on your Paytm app and complete your KYC instantly.

- You can walk upto the nearest Paytm agent in your locality and provide the copy of the documents and complete the process on the same day.

- You can book the schedule with a Paytm agent to visit your home and complete the verification. This process might take upto 7 days.

Q18 : Are there any limits on KYC-enabled Paytm Wallet?

A Full KYC customer can transfer upto Rs 1 lakh to other Paytm users and upto Rs 25000 to any bank account.

Q19 : What are the charges for sending money to the bank for KYC users?

Paytm wallet charges the users 4% of the transfer amount, when transferring money to any bank account or Paytm payments bank. Non-KYC customers cannot transfer money from Paytm wallet to any bank.

Q20 : What are the charges for sending money to other users?

Paytm does not charge any fee for money transfers between Paytm users, merchant payments or for loading money into the wallet.

Q21 : Can I still make payments at any shop without KYC?

Without completing the KYC, a user can make payments to merchant, bill payments with the existing balance. However to load further balance or to receive money from other users, the KYC process needs to be completed. Submit the document ID needed here: http://m.p-y.tm/minkyc

Q22 : Can I still use Paytm at Uber, Zomato, Swiggy and all other apps where I have linked my Paytm without getting KYC done?

Without complete KYC verification, a user can only make payments at any store using the available balance in the wallet. Uber, Swiggy, Zomato and other apps accept payments from Non-KYC customers too. To add further balance, submit your government issued ID here: http://m.p-y.tm/minkyc

Q23 : Will I get cashback if I have not done my KYC?

To enjoy all features of Paytm, like cashback, discount deals, etc customers need to complete the KYC verification. Submit your government issued ID here http://m.p-y.tm/minkyc

Q24 : How much money can I send to my bank account from my wallet?

A Full KYC customer can transfer upto Rs 25,000 to any bank account from the wallet.

Q25 : How can I add money to Paytm wallet?

To load money into your Paytm wallet, a user can try multiple modes like Net banking, Credit card, Debit card, UPI payment, Money transfer from other users etc. Please complete your KYC or submit your government issued ID here http://m.p-y.tm/minkyc to continue adding money to wallet